Everything you think you know about money is wrong when it comes to something called the “National Debt” or the “Deficit.” The video above explains it quite clearly, but I’ll summarize it for you since most people these days don’t have the patience to watch a 13 minute video.

I started my professional life, first being the youngest branch office manager of a New York Stock Exchange firm at 19 years of age. There I was a General Securities and Registered Options Principal (I could make markets in stocks and options) and I was also a Commodities Broker. I then moved to Drexel Burnham Lambert, and later, Lehman Brothers. For the first half of my professional life, my entire career was about money. I got a first-hand look at exactly how money works, and let me tell you, everyone gets it wrong. It’s this ignorance that is allowing the banks to walk all over us.

I started to explain in an earlier video how we have something called “fiat” money in the United States, which means that the money has value because of what it represents and not because it’s backed by something like gold, which also has a fake intrinsic value, by the way, for those “end of the world” people out there who don’t understand that. You can’t eat money people! And it really can be used for anything in a postapocoliptic world!

Money is nothing more than a way of trading your time making or doing things in exchange for someone else’s time and skills at making or doing things.

For example, pre-money days, perhaps it took you 4 hours to make a pair of shoes and it took a shirt maker 4 hours to make a shirt. You would both probably be happy to trade a shirt for a pair of shoes, right?

But once you make that trade, the shirt guy may not want another pair of shoes, but you do want another shirt. What can you do? Well you find out that the shirt guy dies want a new pair of scissors. So you find a guy who makes scissors and you discover that it takes him about 4 hours to make the scissors, and he totally wants a new pair of shoes! Do you trade, get the knife, and bring it to the shirt guy for another shirt. A 3-way trade! You fall three made equal trades and are very happy with the results.

But you can see how all this trading could get very complicated very quickly!

Wouldn’t it be great if you could write on a piece of paper that you are willing to give someone something worth 4 hours of your time for that paper, a shirt, or a new pair of shoes, or s new knife. And if you could simply trade these pieces of paper for things instead of having to track down each person who makes each item to make these complicated 3-way trades?

Well, guess what, that’s exactly what money is.

Money is merely a piece of paper that keeps track of the amount of hours it takes to make or do something that can be traded with someone else for an equal amount of time and services. It’s a score-keeper.

It time-shifts and geographically shifts the equal trades. Can you imagine how long it would take for you to make a toaster, for example?

Since money simply keeps score of your time and skills in exchange for someone else’s time and skills, allowing you to make trades of equal value, you DO NOT want the thing that you write the scores on to have any value itself, because if it did, it would simply confuse things, in fact, it means that we are devaluing your personal labor value by the amount of that intrinsic value of the score keeping coupons. Remember, money is simply a scorekeeper. You could write the score on a worthless piece of paper, but back in the day, anyone could write any score they wanted on pieces of paper (they didn’t have the complex printed pieces of paper we have today), so paper was not a good scorekeeper back then.

Gold got its value from money, not the other way around.

Which is where gold came into the equation. Gold is scarce, and it weighs more than comparable metals, so it’s hard to counterfeit as a result. That made it the perfect scorekeeper at the time. That’s how gold got its value – because of its scarcity and unique qualities that made it hard to fake, it was used to make money. It’s not the other way around, MONEY DID NOT GET ITS VALUE from the gold, money is what GAVE gold its value.

So, back to money and the economy. The entire economy is simply a bunch of scorekeeping coupons floating around. The more scorekeeping coupons out there, the bigger and more robust the economy. A simple scorekeeping coupon goes a LONG way and passes through so many hands.

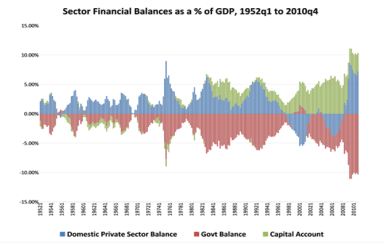

Since the government prints those scorekeeping coupons, every scorekeeping coupon in existence was created by the government. Every single scorekeeping coupon out there is what most people would mistakenly call the national debt, but it’s actually the economy. The “national debt” is actually all the money floating around in OUR pockets, it’s NOT A DEBT! Without the mislabeled “national debt” there would be no coupons floating around and there would also LITERALLY BE NO ECONOMY. On top of that, those government bonds that people like the Chinese “buy” from our government are not “debt” either, they are simply savings accounts where the Chinese like to keep their coupons/money for safe keeping.

A Gov’t Budget Surplus is actually a Budget Deficit FOR US ALL, THE PEOPLE

Which is why we don’t want our government operating at a budget surplus, meaning it’s bringing in more coupons than it’s putting out, because that would mean that the government is PULLING money/coupons out of the the economy. Think about it, for every 100 coupons that you earn, if you’re like most Americans, you will then spend those 100 coupons, and that person you spent them on will also spend them, and so on. The minute the Government says “Give me those coupons” the effect they have on the economy is devastating, because those 100 coupons could have kept a lot of people happy.

that would mean that the government is PULLING money/coupons out of the the economy. Think about it, for every 100 coupons that you earn, if you’re like most Americans, you will then spend those 100 coupons, and that person you spent them on will also spend them, and so on. The minute the Government says “Give me those coupons” the effect they have on the economy is devastating, because those 100 coupons could have kept a lot of people happy.

A government surplus is not actually a dollar-for-dollar deficit to the people, it’s damage is actually multiplied because those same dollars/coupons could have passed through multiple hands, feeding multiple mouths for quite some time. If the government always operated at a surplus, in a few short years, all of the coupons or money in the economy would disappear.

That is why a government budget surplus is a bad thing, period.

But if the government issues too many coupons, won’t it cause inflation?

That is the argument all these RICH people make – inflation.

Well, let’s see. What is inflation? Inflation means that the coupon/dollar you save today won’t be as valuable tomorrow as it is today. But what causes inflation? A booming economy is what causes inflation. One where people are making so much money and have so much to spend that they all start trying to get that same table at the restaurant or they all try to buy the same car and prices inch up a bit as a result of the increased demand.

So, WE, the consumers, cause inflation, not the government. WE cause it by having TOO much money and spending it. Does that sound like a bad thing to you, having too much money to spend? Of course not!

But what if inflation goes up to 3% or even 4%, won’t that hurt us? No, because you’ll have caused the inflation yourself – because you are making money and spending it. On top of that, you’re probably getting a raise at your company to combat the 4% inflation, plus your house has probably gone up in value by an equal amount, so that 4% inflation has ZERO effect on you, ZILCH. 4% doesn’t seem like much, but it’s the HIGHEST inflation we’ve had in the past 10 years, that year being the year that house prices were going through the roof in 2008.

Right now inflation stands at around 1% in the United States. That means that every $1 or 1 coupon you save today will lose a penny or 1/100 coupon in value after a year, which is basically NOTHING. So there is no inflation today.

Right now inflation stands at around 1% in the United States. That means that every $1 or 1 coupon you save today will lose a penny or 1/100 coupon in value after a year, which is basically NOTHING. So there is no inflation today.

Then why is the government trying to pull money OUT of the economy (which is what this whole “Budget Deficit” – “Fiscal Cliff” talk is about, pulling money OUT of the economy.) Doesn’t it HURT the economy to pull money out, and isn’t our economy already hurting right now anyway?

Exactly. It is hurting and pulling money out is the EXACT wrong thing to do right now.

Then why are they doing it?

Because the SUPER RICH are trying to keep the value of their MASSIVE cash holdings as high as possible. A 2-3% change in its value is a FORTUNE for these people.

So they spread these bogus terms and phrases around like the “National Debt that our children WON’T BE ABLE TO PAY BACK,” or the “Fiscal Cliff” where the people are scared into thinking that the “GOVERNMENT CAN’T PAY ITS BILLS,” so we need to make cuts here and there. Get the government to STOP spending money, especially on things like health care, “BECAUSE IT CAN’T AFFORD IT!”

Which is all BULL-SHIT. Complete bull-shit, fed to us in sound bites that make sense to us, because we are stupid and don’t understand how money works (remember, they are billionaires, we are not.)

And we allow ourselves to be beaten into submission, in fact, making our own lives miserable so that these SUPER RICH people can hold on to that extra 3%.

That’s all that this is about, a few percentage points for some VERY rich people.

How else do you explain: Profits that seem to be going through the roof!

The whole EU experiment is a disaster because member countries should NEVER have given up their own currencies, for all the reasons stated above. On top of that, the ECB (European Central Bank) should be SPENDING money in countries with disaster economies, but they refuse so that they can also hold on to those extra few percentage points.

And what did the countries get in return for joining the EU? Unemployment at 27% (up to 75% for the youth in Greece and other countries), salaries down 40% for those with jobs, despair, suicides up, fascism on the rise and because the countries can no longer pay the national debt with their own currencies, the looting of each countries’ assets by foreign entities as repayments for those loans. Boy, this EU thing sounds like a winner, where do we sign up?

To understand fiat money a little better, just read the first few pages of this document: the 7 Deadly Innocent Frauds of Economic Policy.