David Graeber: what the government doesn’t want you to know about debt – video | Opinion | The Guardian

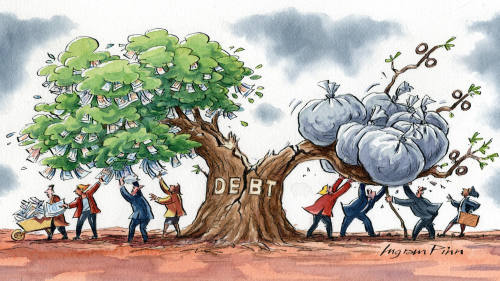

The one taboo of economics that the government is hiding from the public is the fact that if the government balances its books, it becomes impossible for the private sector to do … Continue reading David Graeber: what the government doesn’t want you to know about debt – video | Opinion | The Guardian

You must be logged in to post a comment.